Understanding Medicare & Medi-Cal

Some people qualify for both Medicare and Medi-Cal and are called “dual-eligible” or Medi-Medi beneficiaries. It is important for you to know the differences between Medicare and Medi-Cal, and how Medicare works with Medi-Cal, and who is responsible for paying your medical bills.

It is also important for you to know and understand your options for receiving your Medicare coverage, and, how Medi-Cal works with Medicare for each of the options.

When you have Medicare Parts A and B, Medicare is your primary insurance and pays for most of your medical care. Medi-Cal is your secondary insurance. It pays for costs not covered by Medicare and provides additional benefits not covered by Medicare.

What is Medicare?

Medicare is health insurance for:

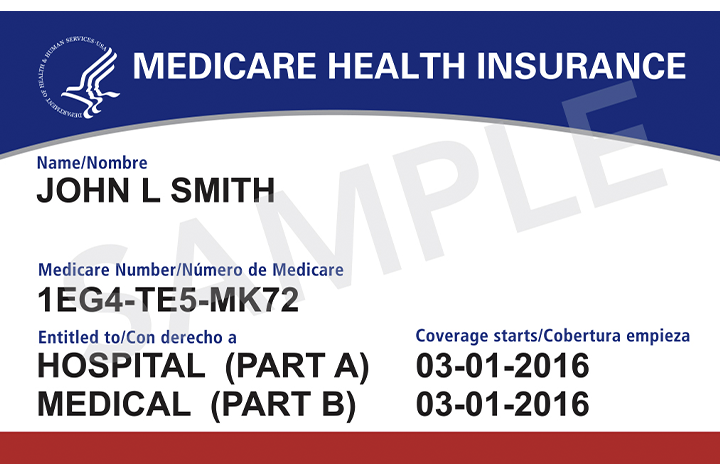

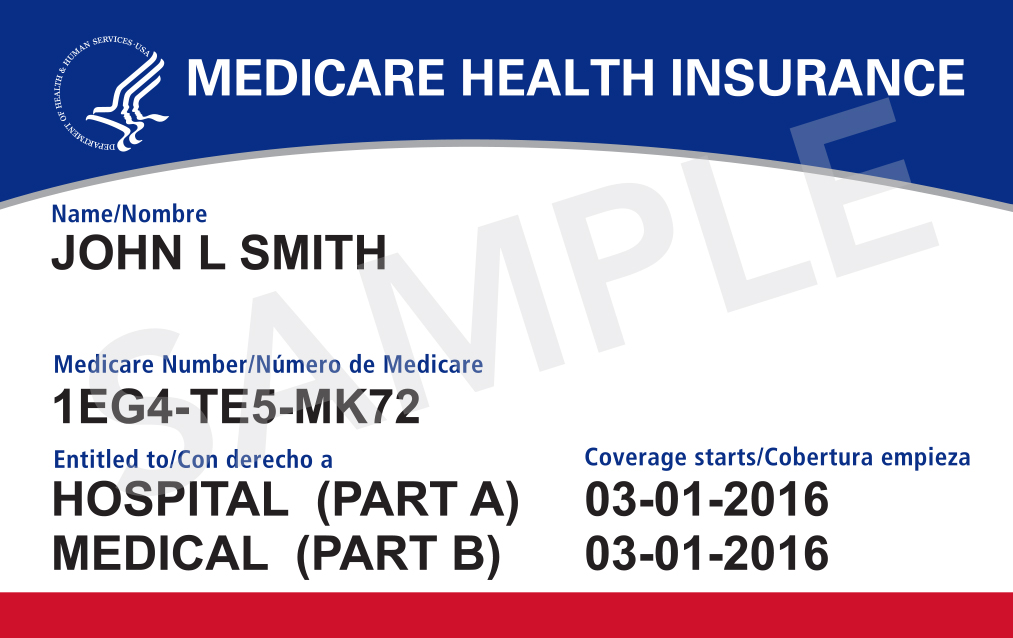

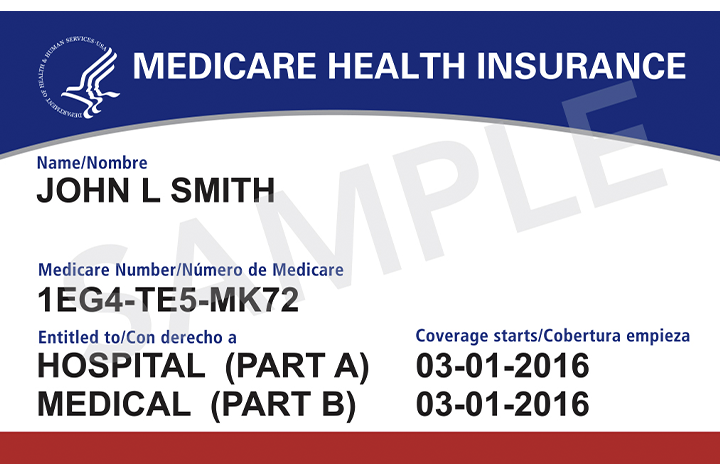

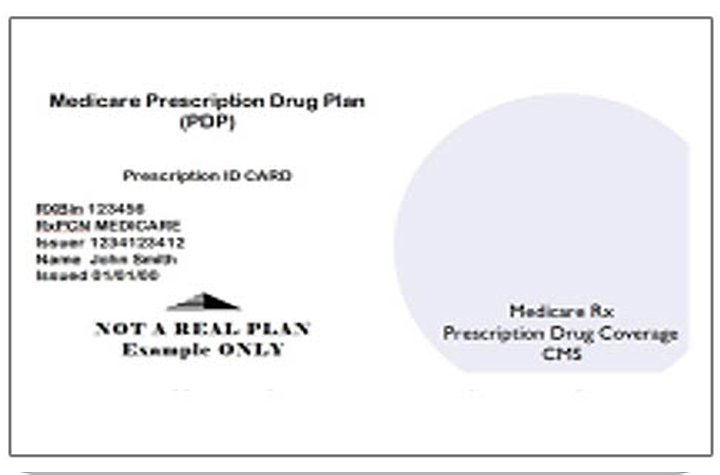

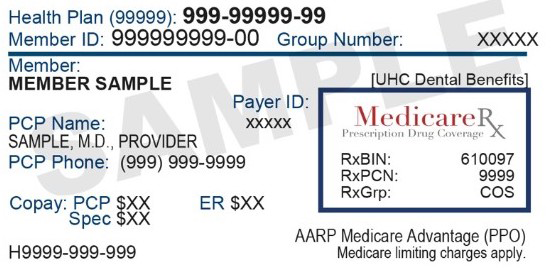

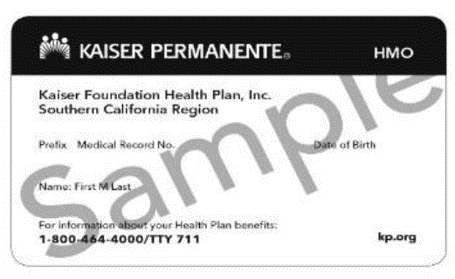

You have Medicare if you have this card:

Medicare consists of 4 parts:

Medicare beneficiaries can choose how to receive their Medicare benefits and services:

What is Medi-Cal?

Medicaid, called Medi-Cal in California, is a joint federal and state program that helps pay medical costs for people with limited income. Some people qualify for both Medicare and Medi-Cal.

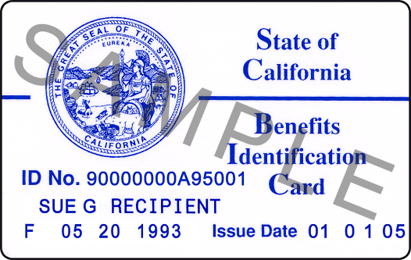

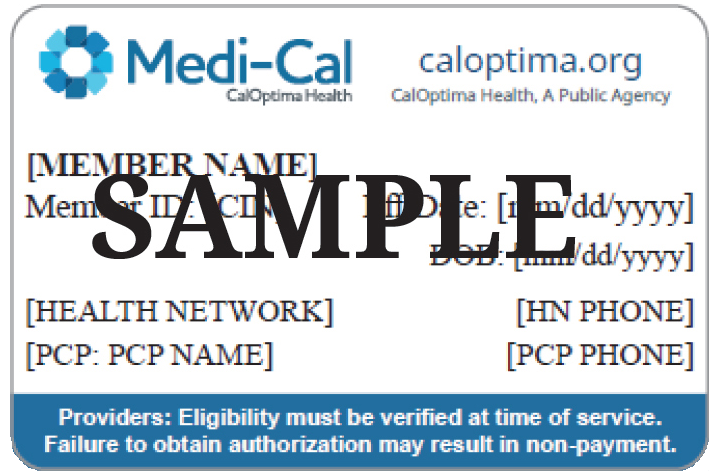

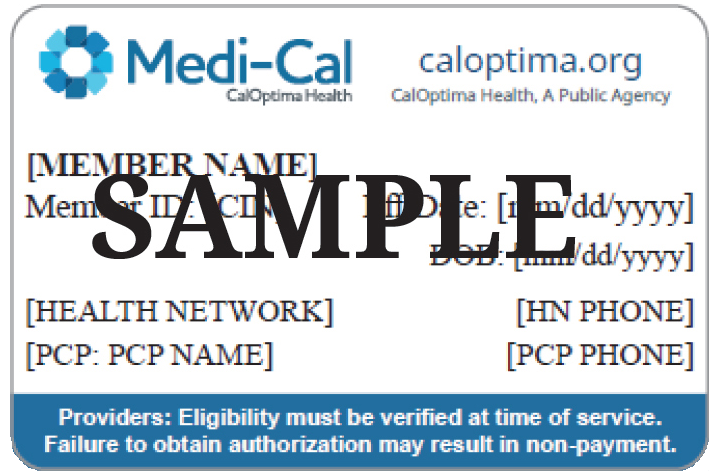

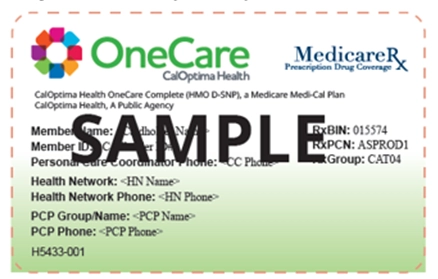

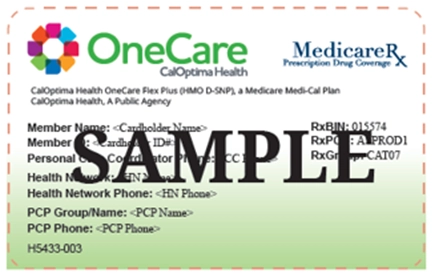

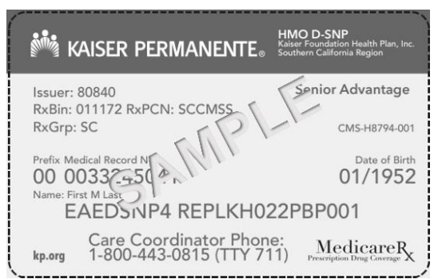

You have Medi-Cal if you have either of these cards:

What does Medi-Cal cover?

How do I qualify?

Your income must meet the state eligibility requirements.

Where do I enroll?

Who administers Medi-Cal in Orange County?

What is Medi-Cal with Share of Cost?

How can I eliminate or meet my share of cost?

What Coverage Options are available for Medi-Medis?

Option 1: Original Medicare

Option 2: Medicare Advantage Plans (MA) (Medicare Part C)

Are there plans just for people with Medicare and Medi-Cal?

Yes. Dual-Eligible Special Needs Plans (D-SNPs) are for people covered by both Medicare and Medi-Cal. These individuals are also referred to as dual-eligible or Medi-Medi. D-SNPs provide Medicare and Medi-Cal benefits, including specialized care and wrap-around services for their plan members.

D-SNPs with exclusively aligned Medi-Cal plans are called Medicare Medi-Cal (Medi-Medi) Plans, which combine Medicare and Medi-Cal benefits, including prescription drug coverage, into one, integrated plan. These plans coordinate your care, benefits, and services across Medicare and Medi-Cal.

In Orange County, three D-SNPs are Medicare Medi-Cal plans. CalOptima Health offers OneCare Complete and OneCare Flex Plus, and Kaiser Permanente offers Dual Complete South P1.

Your Rights & Protections

We Can Help

Call HICAP for additional information or schedule a counseling appointment

HICAP Statewide (800) 434-0222

Orange County (714) 560-0424

Health Insurance Counseling & Advocacy Program

Services also available in Spanish, Vietnamese, Korean, Chinese and Farsi

HICAP does not sell or endorse any insurance products

This project is supported by the Administration for Community Living (ACL), U.S. Department of Health and Human Services (HHS) as part of a financial assistance award totaling $652,622 with 100 percent funding by ACL/HHS. The contents are those of the author(s) and do not necessarily represent the official views of, nor an endorsement, by ACL/HHS, or the U.S. Government.

This product is a result of a project funded by a contract with the California Department of Aging and administered by the Orange County Office on Aging.